Choosing the right loan origination software is crucial for financial institutions looking to streamline their lending processes and improve customer satisfaction. The global loan origination market was valued at $4.89 billion in 2022 and is expected to grow to $13.24 billion by 2031.

In this post, we will look at the ten best loan origination software solutions available today, helping you make an informed decision for your business needs.

What is Loan Origination Software?

Loan origination software is a digital platform that centralizes and automates the different stages of the loan servicing cycle. It's a tool that streamlines tasks from the initial loan application to final approval, including document verification and credit checks, through automated underwriting. Such software supports risk management decision-making and ensures an expedited, accurate lending process.

Why is Having Loan Origination Software Important?

Loan origination software is important for lenders due to its transformational effect on lending. It reduces processing times, mitigates risks by ensuring compliance with regulations, and improves efficiency. It also improves data accuracy and security, giving lenders and borrowers peace of mind. With such software, financial institutions can offer superior customer experiences, foster loyalty, and stay competitively agile in a digital-first market.

Benefits of Loan Origination Software

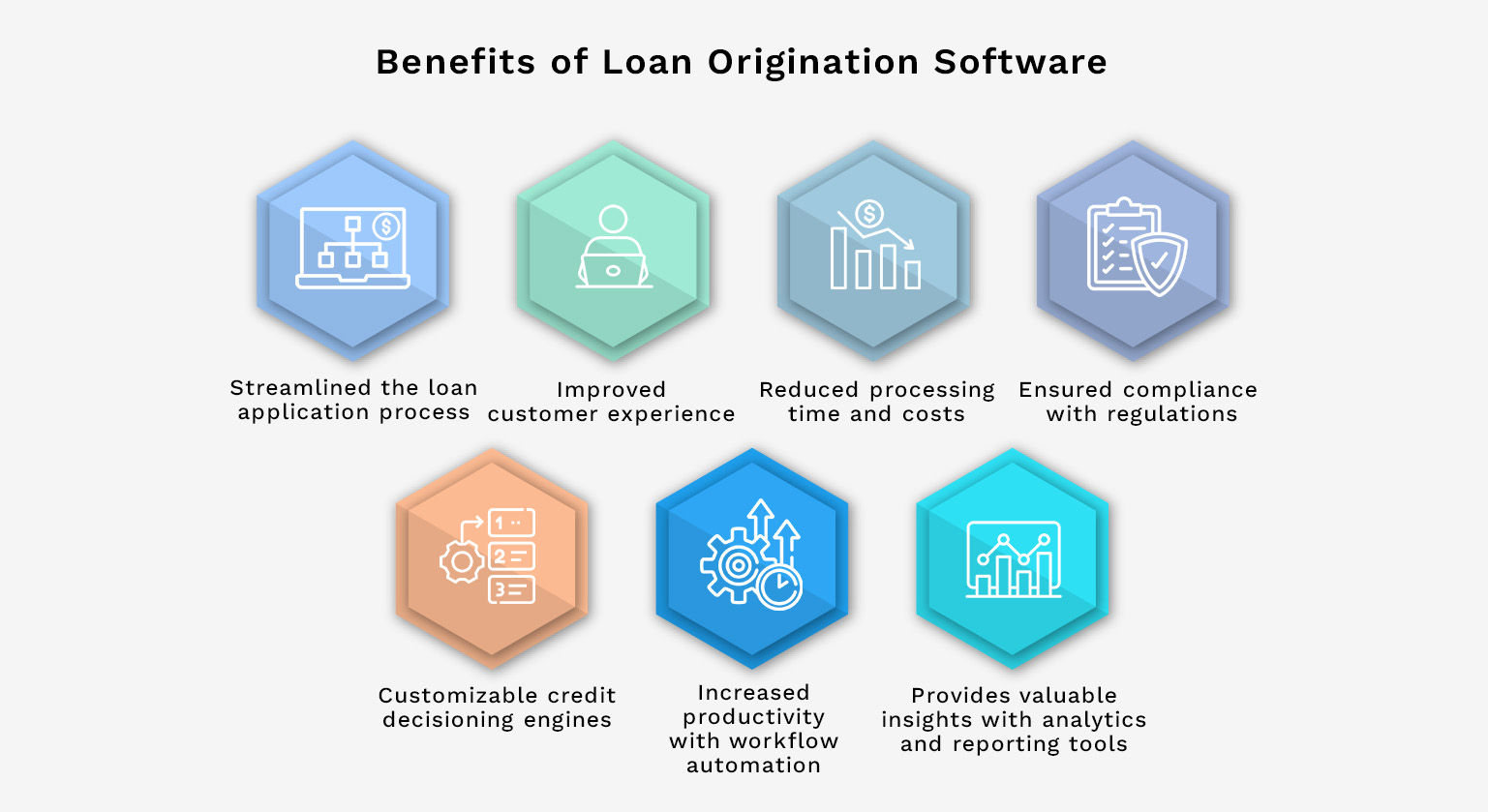

Some of the most important benefits of using loan origination software include:

Streamlined the loan application process

Loan origination software automates routine tasks, such as data collection, credit analysis, and document verification. This leads to quicker loan decisions and a more efficient workflow, allowing lenders to handle a higher volume of applications with greater precision.

Improved customer experience

This type of software provides a straightforward and swift application process, complete with real-time updates and transparent communication. This personalized and hassle-free service increases customer satisfaction and loyalty, positioning lenders as customer-centric in a competitive marketplace.

Reduced processing time and costs

Loan origination software cuts down on manual data entry and redundant steps, significantly decreasing processing times. It also automates tasks that would otherwise require extensive manpower, allowing your team to reduce operational costs.

Ensured compliance with regulations

Loan origination software has compliance modules that automatically update to reflect current laws and lending regulations. This feature ensures that loan processing meets all legal requirements, safeguarding institutions against expensive penalties and preserving their reputations.

Customizable credit decisioning engines

Customizable credit decisioning engines within loan origination software empower lenders to calibrate their risk models according to distinctive business rules and criteria. This flexibility results in more accurate credit assessments and tailored loan products, optimizing the balance between risk management and customer service.

Increased productivity with workflow automation

Workflow automation, a key feature of loan origination software, increases productivity by enabling lenders to configure rules that automatically process applications through different stages, from pre-qualification to closing. Automation eliminates manual bottlenecks, allowing staff to focus on tasks that require human expertise.

Provides valuable insights with analytics and reporting tools

Loan origination software has advanced analytics and reporting tools that provide valuable insights into your lending operations. With the ability to track performance metrics and identify trends, lenders can make informed decisions that improve strategy, improve loan quality, and contribute to business growth.

Top 10 Loan Origination Software Solutions

Here are the top 10 loan origination software solutions, each designed to optimize lending operations and improve customer experience for financial institutions of all sizes.

1. Kohezion

Kohezion stands out with its user-friendly, customizable database that allows lenders to manage client information and track loans effortlessly. Its flexible design made the list because it caters to different lending professionals, from smaller outfits to larger enterprises.

Top 5 Features:

- Customizable online database

- Project management tools

- Task tracking and scheduling

- Advanced search and reporting

- No coding is required for setup

Benefits:

- Simplifies the client and loan data management

- Improves productivity with project management integrations

- Provides a centralized platform for task and schedule tracking

- Offers powerful reporting capabilities for informed decision-making

- User-friendly interface reduces the learning curve for new users

Cons:

- May not offer specialized features for complex lending operations

- Limited third-party integrations compared to some competitors

Best For: Small to medium-sized lending organizations that need a versatile, no-code database solution for managing loans and clients.

2. The Mortgage Office

The Mortgage Office is perfect for mortgage professionals aiming to improve their origination process. They often gain a crucial edge in productivity and compliance across all 50 states, helping to justify its position on the best list.

Top 5 Features:

- Loan origination & servicing

- Borrower & Broker Portals

- Compliance with RESPA regulations

- Web-based software for easy accessibility

- Automation of various lending tasks

Benefits:

- Enables loan origination across all states, ensuring wide geographical serviceability

- Streamlines the lending process, reducing the need for extensive staff

- Facilitates regulatory compliance, minimizing legal risks

- Improves borrower and broker engagement through dedicated portals

- Offers robust analytics for a comprehensive overview of loan portfolios

Cons:

- May present a steeper learning curve due to its extensive features

- Potential higher cost due to its comprehensive functionalities

Best For: A range of clients, including private lenders, non-profits, and municipalities seeking a top-tier, comprehensive loan servicing platform that can handle large volumes and complex loan scenarios.

3. Floify

Floify is a mortgage point-of-sale system designed to optimize the loan origination workflow. With rave reviews for its ease of use and efficiency, Floify earns its spot on the list by offering comprehensive tools suited for mortgage professionals focused on scaling operations and improving borrower satisfaction.

Top 5 Features:

- Document management and automation

- Secure borrower portal for document submission

- Customizable loan milestone updates

- Email and SMS communication tools

- Integration with major credit reporting agencies

Benefits:

- Streamlines document collection, significantly reducing loan cycle times

- Improves borrower experience with a user-friendly portal and timely updates

- Supports loan officer productivity with automated communication features

- Facilitates a paperless environment, reducing physical storage needs

- Improves accuracy and reduces errors by integrating directly with credit bureaus

Cons:

- May require additional training for full utilization of all features

- Integration with some third-party services could be more seamless

Best For: Independent mortgage brokers and mid-sized to large lending firms that are looking to automate and refine their loan origination process with an emphasis on borrower interaction.

4. Calyx Point

Calyx Point is designed specifically for mortgage brokers to simplify every step of the loan process. Its inclusion on this list is well-earned thanks to its comprehensive set of tools that improve operational efficiency and improve customer relations without hidden fees or complex contracts.

Top 5 Features:

- Broad coverage of the origination process from application to closing

- Template-based workflows for standardized files and loan programs

- Marketing tools, including open house flyers and pre-approval letters

- Pre-application data capturing and borrower prequalification

- Extensive integration with over 200 vendor partners for services like credit reporting and compliance

Benefits:

- Ensures a faster, more disciplined loan application process

- Offers marketing support to strengthen broker-borrower relationships

- Upfront cost structure with no surprise fees or contracts

- Enables easy data exchange with a multitude of service providers at a click

- Supports consistency and accuracy with customizable loan program templates

Cons:

- The sheer number of features may intimidate new users

- Some users may require additional customization beyond standard templates

Best For: Mortgage brokers who desire reliable, all-in-one loan origination software that excels in both functionality and ease of integration with third-party services.

5. LendFoundry

LendFoundry is a robust end-to-end lending platform designed to accelerate the loan origination and processing for alternative lenders. It's featured on this list because of its comprehensive functionality, cloud-based agility, and its commitment to streamlining the lending experience for all parties involved.

Top 5 Features:

- API gateway for seamless integrations

- Workflow automation and electronic signature capture

- Customizable user interfaces with credit bureau reporting

- Inbuilt Loan Origination System (LOS)

- Detailed activity dashboard and verification tools

Benefits:

- Facilitates a faster and more efficient loan origination process

- Offers a high degree of customization to suit various lending scenarios

- Promotes better decision-making with advanced reporting features

- Improves borrower satisfaction with self-service portals

- Streamlines the loan management process with powerful automation tools

Cons:

- The vast array of features can be overwhelming for smaller teams

- May involve a learning curve to leverage the customizability fully

Best For: LendFoundry is perfectly suited for alternative lenders looking for a flexible and comprehensive cloud-based platform capable of managing different loan types and complex lending processes.

6. Sageworks Lending Solution

Sageworks Lending Solution, now Arbigo, is a great choice for credit unions and community banks who want a holistic loan management system. Its focus on ensuring speedy yet quality portfolio management secures it a deserving spot on this best list, particularly for new companies and corporations that value efficiency and precision.

Top 5 Features:

- Lending Process Management

- Integrated CRM

- Secure document management

- Pipeline reporting and task notification

- Automatic loan decision templates

Benefits:

- Automates and streamlines the entire loan origination process

- Enables more personalized client interactions with CRM integration

- Assures security in storing and sharing sensitive documents

- Maintains a clear view of the lending pipeline with detailed reporting

- Speeds up loan decisions with pre-configured templates

Cons:

- Full implementation of modules can be pretty time-intensive

- The document library could benefit from more extensive options

Best For: Small to mid-sized financial institutions, such as credit unions and community banks, looking for an expansive yet user-friendly loan management system to support their growth and facilitate effective team collaboration.

7. LendingWorks

LendingWorks, now Fluro, is a comprehensive, cloud-based platform for private and commercial lending. It offers a user-friendly, end-to-end digital lending experience that encompasses a wide range of loan products.

Top 5 Features:

- Customizable loan product configurations

- Mobile-friendly borrower and broker portals

- End-to-end management from origination to closing

- Real-time document collection and status updates

- Strong security measures with bank-level encryption

Benefits:

- Personalizes the loan origination experience with adjustable loan strategies

- Facilitates on-the-go loan management and application submission via mobile compatibility

- Streamlines loan processes, reducing the time from application to closing

- Improves collaboration among all stakeholders through shared access and updates

- Protects sensitive information with top-notch security standards

Cons:

- The wide range of features might require a significant setup period

- Small lenders might find the system more complex than necessary

Best For: Diversified lenders who wish to offer a seamless, secure, and comprehensive digital experience to their customers, and for those who handle large volumes of various loan types.

8. Byte Software

Byte Software streamlines the mortgage loan origination process with different time-saving features. Praised for its adaptability and robust support system, Byte Software appeals to lenders who want a blend of power, customization, and user-friendliness in their origination software.

Top 5 Features:

- Comprehensive loan origination system

- Integrated business rules engine

- Customizable workflows and interfaces

- Extensive third-party service integrations

- Regulatory compliance tools

Benefits:

- Simplifies the entire mortgage process from lead to close

- Reduces manual tasks through business rules automation

- Tailors to specific organizational needs with a high level of customization

- Connects seamlessly with credit reporting, underwriting, and other essential services

- Ensures adherence to industry compliance standards to mitigate risk

Cons:

- The customization options may result in a steep learning curve for some users

- The initial setup can be time-consuming as it is tailored to specific business needs

Best For: Mortgage lenders and banks that require a highly customizable and full-featured mortgage origination platform to handle complex lending scenarios and compliance requirements.

9. ICE MOrtgate Technology

ICE Mortgage Technology stands out for its all-encompassing approach, integrating task-based automation to streamline the entire loan origination cycle. It's praised not only for enhancing borrower experience but also for its ability to strengthen operational efficiencies.

Top 5 Features:

- Integrated suite of origination performance solutions

- Task-based automation for advanced processing

- Cloud-based platform mitigating hosting and maintenance costs

- Pre-configured workflows adhering to industry standards

- Comprehensive coverage of mortgage channels on a single system

Benefits:

- Delivers an inclusive digital ecosystem for greater savings and convenience

- Optimizes processing with automation, cutting down on repetitive tasks

- Reduces operational costs with a cloud-based system requiring no on-premises infrastructure

- Facilitates a smooth homebuying experience for borrowers with efficient loan processing

- Minimizes risk with advanced decisioning capabilities

Cons:

- Its extensive suite of features might be more than what smaller lenders need

- The system's robustness may demand a period of adaptation for new users

Best For: Black Knight Empower is best for larger mortgage lenders or financial institutions seeking a top-of-the-line, comprehensive loan origination system that offers a refined mortgage lending process on a unified digital platform.

10. CIM GOLD

CIM GOLD is a premiere loan origination and servicing solution for institutions managing a sizable portfolio of loans. Its all-in-one nature makes it a go-to choice for many professionals.

Top 5 Features:

- Integrated account processing platform

- Robust loan origination and servicing capabilities

- Real-time transaction processing

- Advanced collateral management

- Customizable reporting and analytics tools

Benefits:

- Provides comprehensive management across all stages of the loan process

- Ensures accuracy and efficiency with instantaneous updates and transactions

- Improves risk management with detailed collateral tracking

- Offers detailed insights and reporting for better portfolio monitoring

- Adaptable to both consumer and commercial lending requirements

Cons:

- Can be complex to implement due to its depth of features

- May require additional training to maximize its full potential

Best For: CIM GOLD is ideal for banks and credit unions that manage a diverse and extensive loan portfolio and need a robust system to handle high transaction volumes seamlessly.

Key Features to Look for in Loan Origination Software

When selecting loan origination software, it's important to consider key features that can streamline processes and improve productivity. Here are some essential features to look for when choosing the right solution for your financial institution.

1. Process Automation

Process Automation eliminates repetitive manual tasks such as data entry, document collection, and initial borrower assessment. This significantly increases the speed and accuracy of the loan origination process, enabling lenders to make quicker decisions and focus their attention on more strategic activities.

2. Data Collection and Management

Data collection and management are streamlined with loan origination software, ensuring all pertinent borrower information is easily captured and stored securely. This results in an organized, accessible data repository, improving accuracy, protecting against data loss, and facilitating easier audits and compliance checks.

3. Customized Workflows

Customized workflows allow lenders to tailor the loan process to align with their unique business practices. With this ability to fine-tune, lenders can optimize operations efficiently, improve client responsiveness, and maintain a high level of service customization.

4. Platforms and Integration

Platforms and integration capabilities ensure that loan origination software plays well with other systems, such as CRMs, analytics, or document management systems, creating a unified and streamlined ecosystem. This interconnectivity promises a smoother, more coordinated operation, which can widely improve organizational efficiency.

5. Reporting and Analytics

Reporting and analytics features grant lenders a detailed overview of their operations with real-time data. These tools offer insights into loan performance, bottlenecks, and customer trends, facilitating strategic decision-making and helping to refine the lending process.

6. Security and Privacy Protection

Security and privacy protection safeguards sensitive financial data against breaches and unauthorized access. With features like data encryption, role-based access control, and regular security audits, these systems ensure compliance with privacy laws and instill trust among borrowers.

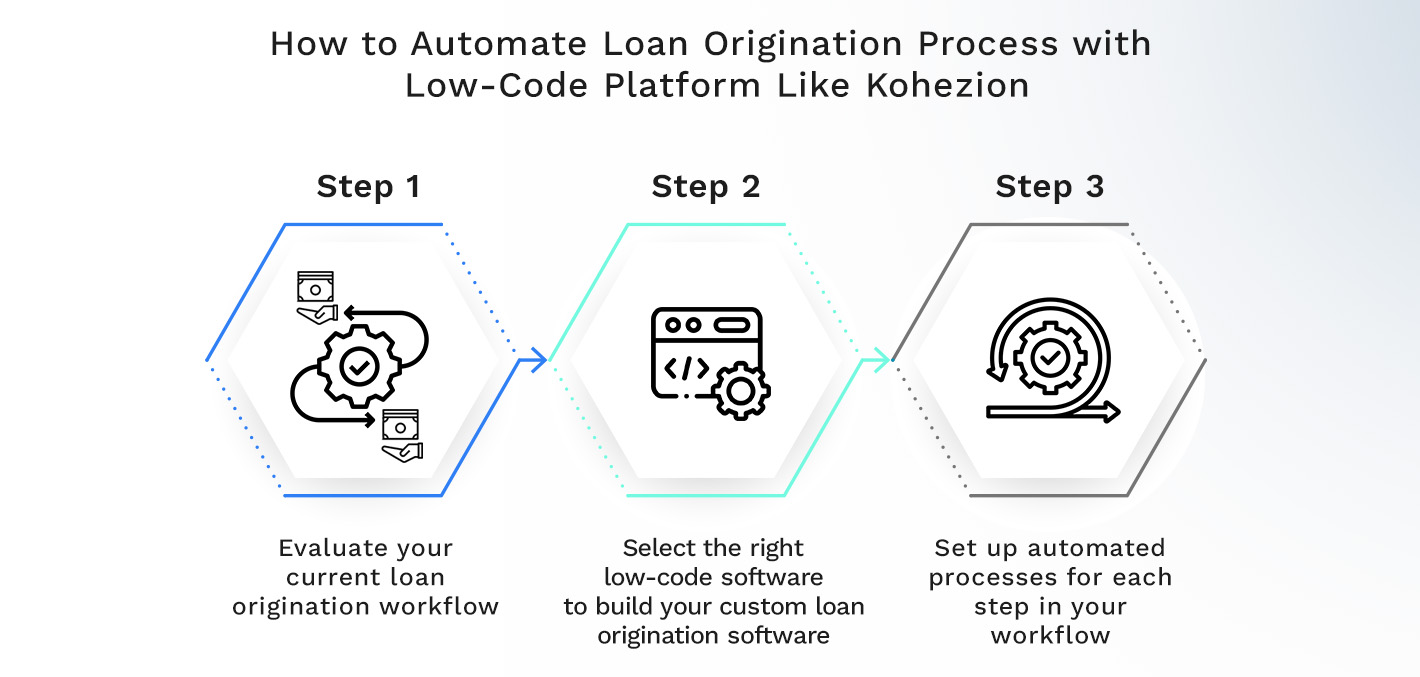

How to Automate Loan Origination Process with Low-Code Platform Like Kohezion

Here's a simple guide on automating the loan origination process using a low-code platform like Kohezion. This allows financial institutions to streamline operations and increase efficiency effortlessly.

Step 1: Evaluate your current loan origination workflow

To improve your loan origination processes, start by examining each step—from loan application and underwriting to credit approval, documentation, pricing, funding, and the final disbursement or rejection of applications. Identify any existing bottlenecks or inefficiencies and benchmark your procedures against industry standards.

Assess the technologies employed in your current system, such as intelligent workflow automation, exception-based processing, and integrated data and pricing. Ensure that your system aligns with industry security regulations to protect customer data adequately. Explore integration possibilities with other front-end and back-end applications to ensure a seamless digital lending experience. Evaluate the results of your current process, considering factors like processing time and rejection rates.

Research and review different loan origination software options available in the market, noting their features, pros, and cons for future reference.

Step 2: Select the right low-code software to build your custom loan origination software

In the second step of creating your custom loan origination software using low-code development, choosing the appropriate low-code software platform is essential. To do this, follow these key considerations:

Firstly, identify your specific needs, considering the size of your business and the complexity of your loan portfolio. Establish criteria related to price, usability, functionality, and integrations.

Next, during the evaluation process, prioritize features that improve automation, such as centralized document tracking and automated underwriting. For larger enterprises, focus on advanced features like CRM integration, integrated payment gateways, and analytical dashboards to meet more complex requirements.

Emphasize ease of use by ensuring that the chosen low-code software provides an intuitive loan application dashboard, facilitating straightforward navigation for experienced and novices. Confirm that the low-code software seamlessly integrates with your existing CRM, accounting systems, and project management tools to support efficient communication and workflow.

Lastly, consider specialized options, particularly if you are a best-of-breed buyer. Explore specialized solutions tailored to loan financing and accounting needs, offering features designed specifically to optimize your loan management processes.

Step 3: Set up automated processes for each step in your workflow

Begin by opting for a cloud-based platform to reduce hosting costs. For the loan application phase, automate online submissions for the borrower. Improve efficiency with intelligent workflow automation and integrated data to streamline data entry.

In loan processing, achieve near-instant auto-processing of loans. Improve pipeline management through task segmentation. Enable automatic approval during the approval stage. Manage anomalies effectively by implementing exception-based processing.

Automate fund disbursement and centralize the source system to minimize data transfer issues. Implement automation for post-closing processes and increase efficiency with automated document collection systems.

Kohezion Can Help You Automate the Processes

Kohezion offers a comprehensive solution to automate loan origination processes efficiently. With its user-friendly interface and customizable features, Kohezion allows financial institutions to streamline operations, reduce manual errors, and expedite lending.

Kohezion's low-code platform empowers lenders to automate repetitive tasks, track application statuses in real-time, and ensure compliance with regulatory requirements, from initial application intake to final approval. With Kohezion, financial institutions can improve operational efficiency and deliver a seamless borrowing experience to their customers.

Conclusion

The right loan origination software can revolutionize how you approach lending operations, defining the difference between surviving and thriving in the industry. It promises improved efficiency and compliance and an unmatched experience for your borrowers. As you consider the options, remember that the best choice will align with your business needs, scale with your growth, and seamlessly integrate into your existing tech stack. Embrace the digital transformation, and you'll set your institution up for success in today's competitive landscape.

Contact Kohezion today to discuss how our Loan Origination Software solutions can be customized to fit your lending needs.

Start building with a free account

Frequently Asked Questions

Loan origination software improves compliance and security by automating regulatory adherence and safeguarding data. It updates in real-time to reflect the latest regulations, taking the guesswork out of compliance. Encryption, access controls, and secure data storage are standard, ensuring customer information is protected against unauthorized access and breaches.

Yes, most loan origination software is designed to integrate seamlessly with other business systems—like CRMs, accounting software, and document management tools—creating a cohesive operational flow and centralized data repository.

A Loan Management System (LMS) is an extensive software solution designed to manage and automate the entire lifecycle of a loan. It encompasses activities including loan origination, processing, disbursement, servicing, and closure.

Loan Origination Software (LOS) is a specialized subset within LMS, primarily focused on managing and streamlining the loan origination phase. This includes elements like automating application generation, tracking data, compliance facilitation, and issuing credit decisions. This system's key benefits include reducing manual paperwork and providing lenders with a platform to manage loan products, customize workflows, and reduce compliance risk. It serves as a one-stop shop for all actions related to the inception of a loan.

Mortgage processors commonly use loan origination software to manage and automate the mortgage lending process, effectively improving efficiency and reducing costs. One of the most popular solutions is "Mortgage Automator," preferred for these noteworthy features:

- Intelligent workflow automation: Simplifies the loan application process, enabling quicker approvals and denials.

- Integrated data and pricing: Assists in accurate decision-making.

- Exception-based processing: Makes it easier to detect and handle unusual cases.

- Modern digital solutions: Digitizes the mortgage lending experience, making it more streamlined and less time-consuming.

- Built-in integrations with popular LOS systems, QuickBooks, and Microsoft products: Ensures compatibility and seamless operations with existing systems.