FINRA (Financial Industry Regulatory Authority) compliance is integral to any broker-dealer business with operations in the United States. Compliance with FINRA means adhering to ever-changing U.S. SEC rules, managing records effectively, and conducting audits without roadblocks. This is where a FINRA-compliant CRM emerges as a vital tool for financial advisors.

What is FINRA?

The Financial Industry Regulatory Authority (FINRA) is a non-governmental organization and self-regulatory body overseeing brokerage firms and registered brokers in the United States. Established in 2007 through the consolidation of the National Association of Securities Dealers (NASD) and the regulatory functions of the New York Stock Exchange (NYSE), FINRA is tasked with protecting investors and maintaining the integrity of the financial markets.

It achieves this through the formulation and enforcement of rules and regulations that govern the conduct of its member firms and their associated professionals. FINRA's primary objectives include fostering fair and transparent financial practices, resolving disputes, and providing educational resources to empower investors and promote confidence in the securities industry.

FINRA Compliance Requirements 101

Within the sphere of financial regulations, FINRA has instituted a set of compliance requirements aimed at ensuring the transparency and integrity of financial transactions. Here's a comprehensive overview:

- Financial advisors are obligated to maintain meticulous written records encompassing all communications and transactions relevant to their business.

- These records must be systematically indexed and stored in a manner facilitating easy retrieval, readability, and downloadability.

- Enforceable retention policies must be in place to govern the lifecycle of these records.

- To mitigate the risk of loss due to physical damage or technological malfunctions, data duplication and storage in separate locations are mandatory.

These requirements extend across the spectrum, encompassing all broker-dealers, capital acquisition brokers, and funding portals.

Best CRM Software for Financial Advisors in 2024

1. Kohezion

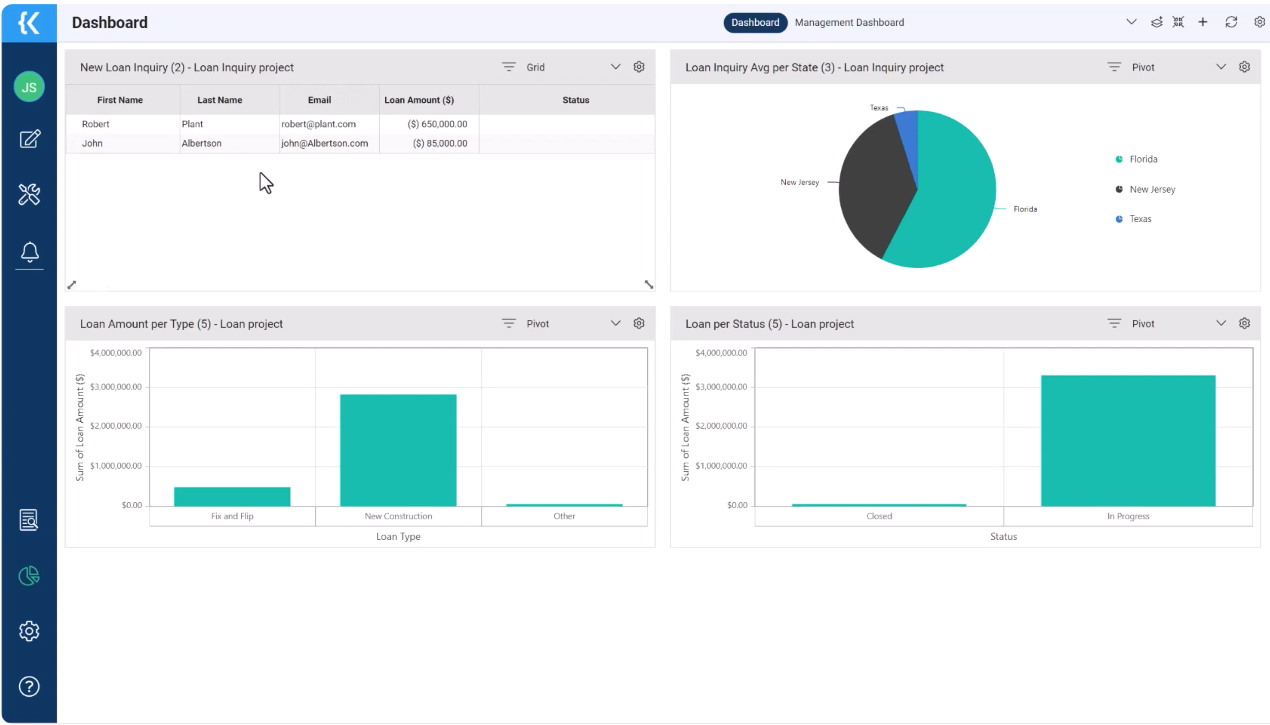

Kohezion is a one-stop platform for all organizational software needs, from CRM, ERP, time tracking, workflow automation, and a nearly limitless number of internal tools that you can build yourself using Kohezion's no-code builder.

Why it made the list: Kohezion's straightforward interface and powerful features, including automatic data import from various sources, and automatic expense categorization, make it a go-to choice.

Top 5 Features:

- No-Code Builder

- Workflow Management

- Process Automation

- Client Portal

- Client Relationship Management

- FINRA Compliance Support

Best For: Financial advisors who've tried other tools and are not able to find the one that fits their unique needs.

2. Topaz Advisor

Ranked as one of the finest CRM software for Financial Advisors in 2023, Topaz Advisor is tailored to meet the needs of small to medium financial planning firms. It stands out due to its user-friendly interface and robust functionality.

Topaz Advisor's features are specially designed for ease of use and handle a range of functionalities, from client relationship management to robust reporting tools.

Top Features:

- Client Relationship Management

- Easy navigation and usability

- Efficient client communication

- Seamless integration with other financial planning tools

- Powerful automation of mundane tasks

- Complies with industry-specific guidelines and regulations

Best For: Small to medium financial planning firms looking for an uncomplicated, yet feature-rich CRM

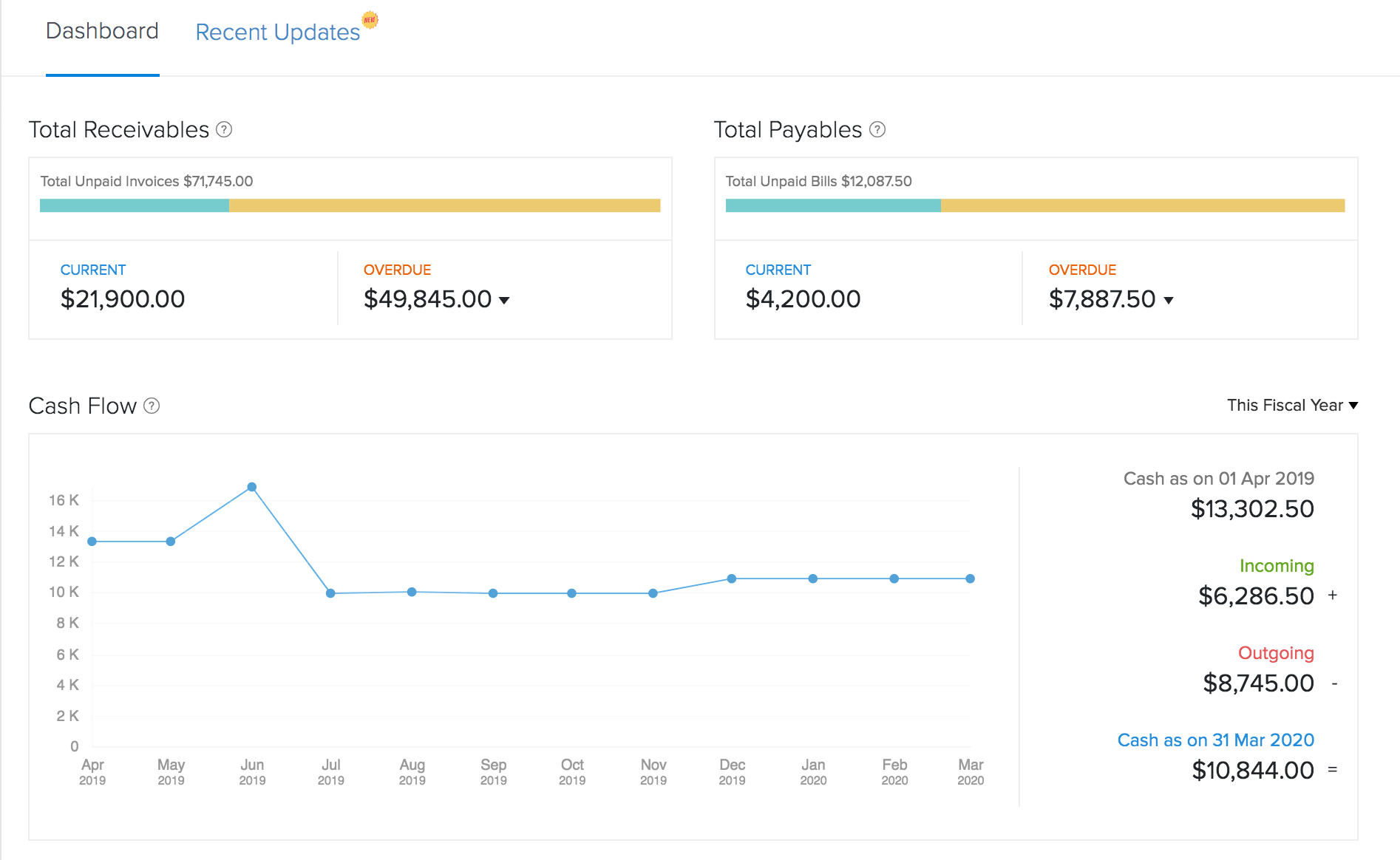

3. Zoho Books

Zoho Books, part of Zoho's extensive suite of business software, emerges as a front-runner for financial advisors due to its capability to seamlessly integrate with an array of Zoho services.

With an easy-to-use interface and robust set of capabilities, Zoho Books offers everything a financial advisor needs. It provides a unified view of the contacts, improving the user experience, and keeps track of transactions across multiple institutions.

Top 5 Features:

- Streamlined Invoicing

- Smart Banking

- Detailed Reporting

- Client Portal

- FINRA Compliance Support

Best For: Financial advisors who want a comprehensive tool suite for managing their processes.

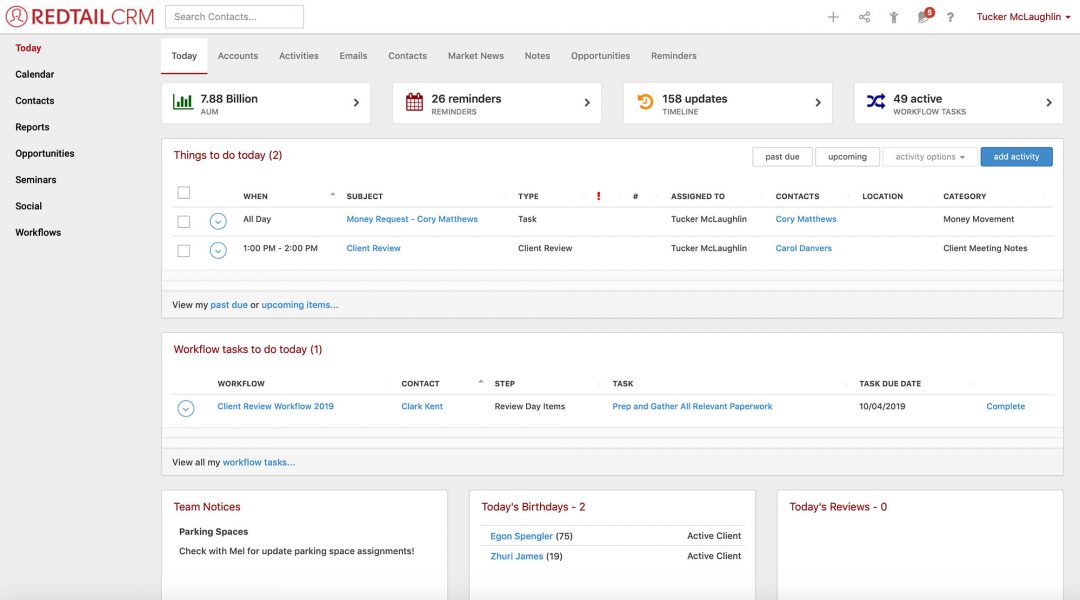

4. Redtail CRM

Redtail CRM is a popular solution in the financial advisor space, optimized for use on any mobile device. Many financial advisors favor it for its robust platform that's easy to learn, and a wide range of integrations with popular industry tools.

Redtail CRM's primary appeal lies in its user-friendly interface, comprehensive feature set tailored to financial advisors, and price model per database rather than per user, making it ideal for teams that want to scale up.

Top 5 Features:

- Contact and Lead Management

- Workflow Automation

- Customizable Reporting

- Wide Integrations with Industry Tools

- Seminar Management

Best For: Small to Medium firms wanting a user-friendly CRM with robust features and an array of industry tool integrations.

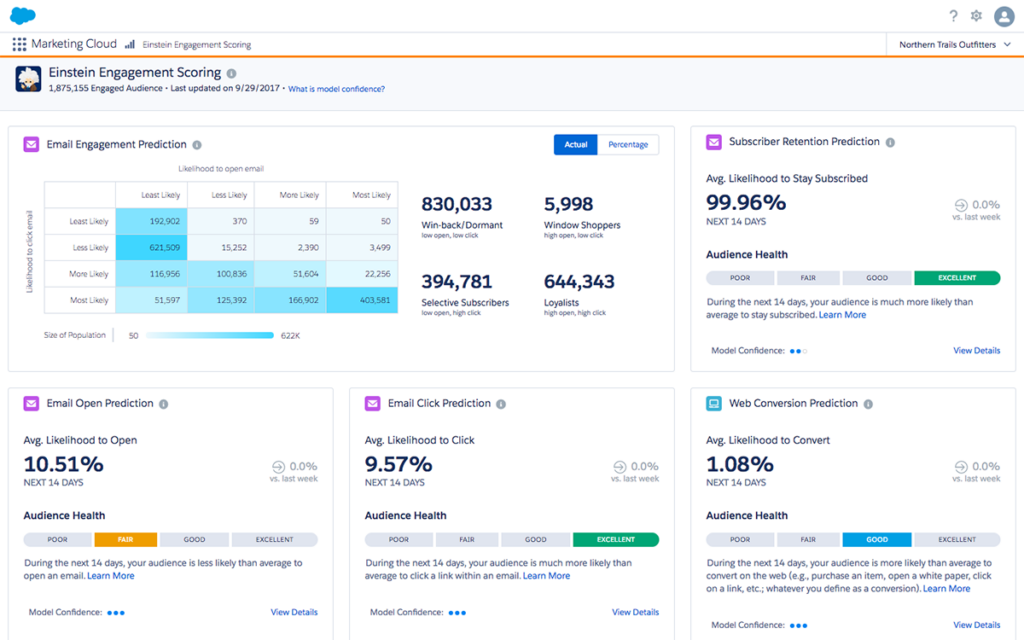

5. Salesforce

Salesforce, a premier cloud-based CRM, is lauded for its scalability and adaptability. It earns its spot on this list due to unrivaled market dominance and a rich array of customization options that cater to diverse business needs.

With a vibrant community and robust ecosystem, Salesforce fosters innovation, providing users with continuous updates and support to stay at the forefront of evolving industry requirements. Its mobile capabilities empower users to stay connected and productive on the go, contributing to seamless and efficient financial operations.

Noteworthy features include:

- advanced analytics

- collaborative forecasting

- lead management

- automation workflows

- an intuitive user interface.

Best for: large enterprises, Salesforce excels in providing a comprehensive suite of tools for sales and customer relationship management, ensuring transparency and efficiency in financial transactions and compliance with stringent FINRA regulations, making it an indispensable asset for organizations navigating the intricacies of financial compliance.

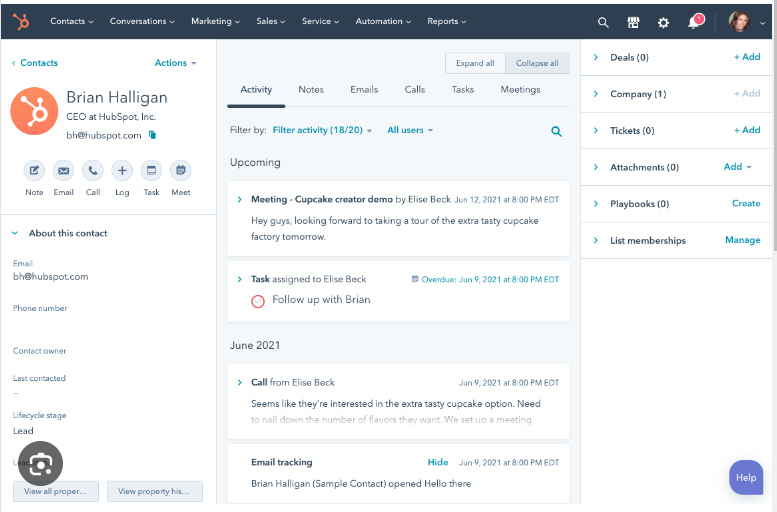

6. HubSpot CRM

HubSpot CRM distinguishes itself with a user-friendly interface and seamless integration with HubSpot's suite of tools, earning its place for simplicity tailored to small to mid-sized businesses.

HubSpot's commitment to education and community engagement further sets it apart, with a wealth of resources and an active user community fostering continuous learning and growth. Its robust reporting capabilities enable users to derive meaningful insights, enhancing strategic decision-making and financial planning.

Top features are:

- contact and lead management

- email tracking

- deal tracking

- task automation

- visual dashboard

Best for: businesses seeking an intuitive platform to centralize customer data, streamline sales processes, and execute targeted marketing campaigns, all while adhering rigorously to FINRA compliance requirements that underpin transparent and accountable financial practices.

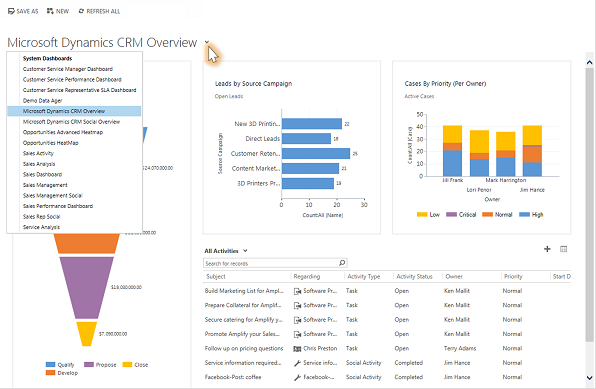

7. Microsoft Dynamics 365

Microsoft Dynamics 365, an integrated business application suite, stands out for its deep integration with Microsoft's productivity tools, earning its place as a comprehensive solution.

Microsoft's commitment to continuous improvement is evident through regular updates, ensuring users have access to the latest features and enhancements to meet evolving business needs. Its user-friendly interface and customizable dashboards empower users to tailor their CRM experience to suit specific financial workflows.

Key features include:

- AI-driven insights

- workflow automation

- customer journey mapping

- sales forecasting

- multichannel engagement.

Best for: businesses seeking seamless integration across sales, customer service, marketing, and operations. It provides a unified data platform, enhancing efficiency in financial transactions and ensuring meticulous compliance with FINRA regulations, thus bolstering organizational resilience in the complex financial landscape.

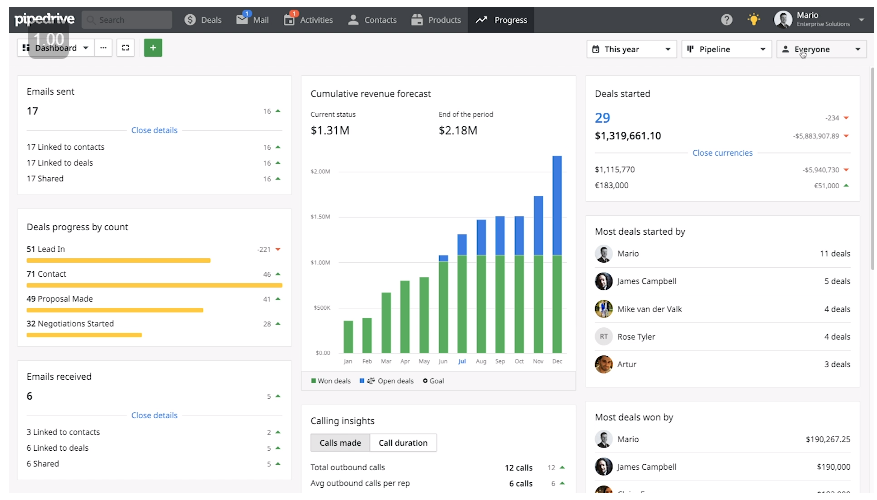

8. Pipedrive

Pipedrive, an intuitive CRM solution, prioritizes sales pipeline management, earning recognition for its simplicity in serving sales-driven organizations.

Pipedrive's commitment to user feedback and iterative development ensures that the platform evolves in tandem with user needs, fostering a collaborative and responsive CRM experience. Its integrations with popular third-party tools enhance the overall user experience, facilitating a holistic approach to financial management.

Key features include:

- drag-and-drop deal tracking

- email integration

- goal setting

- activity reminders

- detailed sales reporting

Best for: startups and businesses seeking straightforward CRM functionality. It efficiently manages leads and guides progress through the sales pipeline, ensuring adherence to FINRA compliance requirements and contributing to the seamless orchestration of financial transactions in a dynamic and competitive business environment.

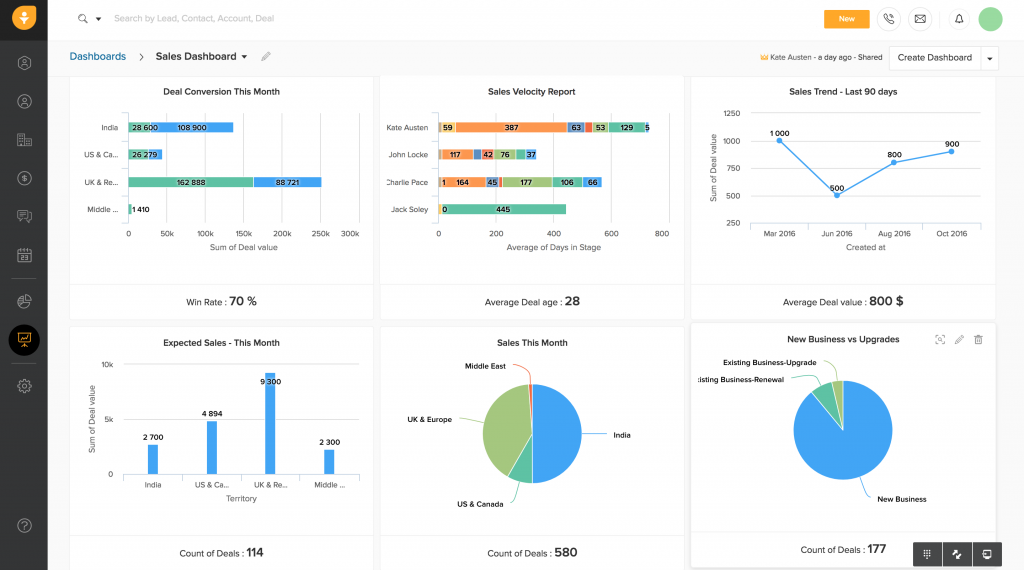

9. Freshsales

Freshsales, an AI-driven CRM solution, is celebrated for its emphasis on user experience. It provides a user-friendly platform for managing customer relationships and financial transactions, enhancing operational efficiency and fostering sustainable financial practices.

Freshsales' commitment to innovation is evident through regular updates, ensuring users benefit from the latest advancements in AI and CRM technology to stay ahead in the competitive financial landscape. Its scalable architecture accommodates the evolving needs of businesses, ensuring long-term adaptability and growth.

Top features are:

- lead scoring

- integrated phone capabilities

- visual sales pipelines

- contact management

- AI-driven insights

Best for: businesses looking to leverage artificial intelligence for smarter sales processes, task automation, and actionable insights, all while ensuring strict compliance with FINRA regulations.

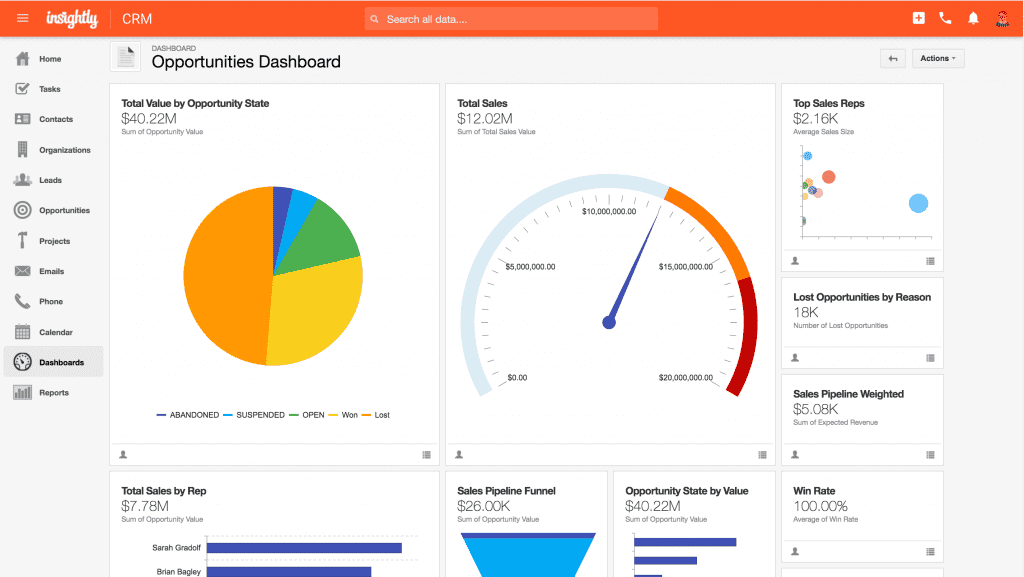

10. Insightly

Insightly, merging CRM with project management, is uniquely valuable for businesses prioritizing both facets.

Insightly's commitment to integration capabilities and scalability ensures businesses can adapt and grow seamlessly, addressing evolving CRM and project management needs with ease. Its collaborative features enhance teamwork and communication, fostering a cohesive and efficient financial management process.

Noteworthy features:

- lead and contact management

- project and task management

- email tracking

- reporting

- integrations

Best for: businesses emphasizing project management alongside traditional CRM functionalities, it serves as an excellent choice for service-oriented industries and project-based teams. Insightly ensures compliance with FINRA regulations while efficiently managing client relationships and overseeing project workflows, contributing to transparent and accountable financial practices in dynamic business environments.

Features You Need In a FINRA-Compliant CRM

1. Preserve Records Exclusively in a Non-Rewritable, Non-Erasable Format

As part of FINRA compliance, firms are required to store electronic records in a non-rewritable and non-erasable format. Known as the Write Once, Read Many (WORM) format, it ensures that the stored data can't be altered or deleted during the required retention period. This requirement is critical in maintaining the integrity and authenticity of the records, preventing tampering or unintended modifications. As such, a CRM that supports this feature helps firms comply with the SEC 17a-4 regulation.

Kohezion's FINRA-Compliant CRM system preserves records such as trade confirmations, account statements, and other important client communication, ensuring they cannot be altered or erased after the fact.

2. Automatically Verify the Quality and Accuracy of the Storage Media Recording Process

For a CRM system to be FINRA compliant, it must have the capability to verify the accuracy and quality of the storage media recording process automatically. It involves comparing a computational check of the file before and after it has been written to storage. This process validates the backup and verifies it matches the source data to preserve data integrity and authenticity.

Kohezion uses the process of generating a hash that can be cross-verified to ensure that the backup's content preserves the original data's integrity. It also stores the backup in a compressed form that incorporates cyclic redundancy checks (CRC) to provide error detection and integrity verification.

3. Serialize and Time-Date For the Required Retention Period

Serialization and time-dating are other critical features required for a CRM to be FINRA-compliant. In simple terms, every record must be assigned a unique identification number (serialization) and a timestamp indicating when the record was created. These elements play an integral part in creating an audit trail for each record, facilitating the identification of records, and establishing a timeline of their life cycle.

At Kohezion we take this requirement quite seriously and create metadata for every backup it performs. This metadata includes a serialized timestamp, a unique ID, and an index to efficiently manage records during the required retention period.

4. Have the Capacity to Readily Download Indexes and Records

To comply with SEC 17a-4, a firm's electronic storage media must "have the capacity to readily download indexes and records preserved on storage media to any medium acceptable. This stipulates that the CRM systems used by financial advisors must allow easy download of indexes and records in a format that's comprehensible and useable.

Kohezion provides multiple downloading and exporting capabilities for customers and auditors that include exporting full indexes of all backups over specific periods, exporting specific files and metadata, and exporting indexes with timestamps and associated hashes to validate data integrity.

5. Store Separate, Duplicate Copies of All Retained Data

As per SEC 17a-4, Financial Services firms must store a separate, duplicate copy of all retained records. This is to provide a backup source for accessing records if the primary source is lost or damaged. This requirement ensures that even in scenarios of catastrophic events, the record's integrity and availability are uncompromised.

Kohezion creates and replicates encrypted snapshots across separate storage systems. It maintains the replicated data's integrity throughout its lifecycle across multiple zones within the customer's storage region.

Build a FINRA Compliant CRM with Kohezion

I hope this article helped you understand what FINRA compliance means for a CRM. It's important for financial institutions to work with a CRM vendor to ensure that it is configured and used in a manner that aligns with FINRA's rules. Kohezion provides various tools and features that can assist in meeting these compliance requirements.

Kohezion's consultants can help your organization implement and maintain a FINRA-compliant CRM solution.