Did you know 56% of companies spend more than 10 hours per week on accounts payable? That's a lot of time that could be used on more important tasks. Luckily, there's a solution: accounts payable automation software. This software helps companies manage invoices faster, be more efficient, make fewer mistakes, and handle money better.

In this post, we will examine the best 9 accounts payable automation software for 2024. These programs are designed to help you save time and money and work better.

What Is Accounts Payable Automation Software?

Accounts payable automation software uses AI and machine learning to handle invoice processing and payments, making the whole process easier.

This software eliminates the need for manual work. Accountants can focus on important tasks because it does the repetitive work for them. It also makes invoice processing faster and more accurate, leading to fewer mistakes.

It does many things, like capturing invoices and managing approvals, without manual input. This means less stress and more time for strategy. It's also good at scheduling payments promptly and accurately so vendors get paid on time.

Accounts payable automation software also helps companies spot trends and manage cash flow better by providing quick reports. It's a game-changer for businesses, making their financial operations smoother and saving money. It also improves how companies deal with their vendors.

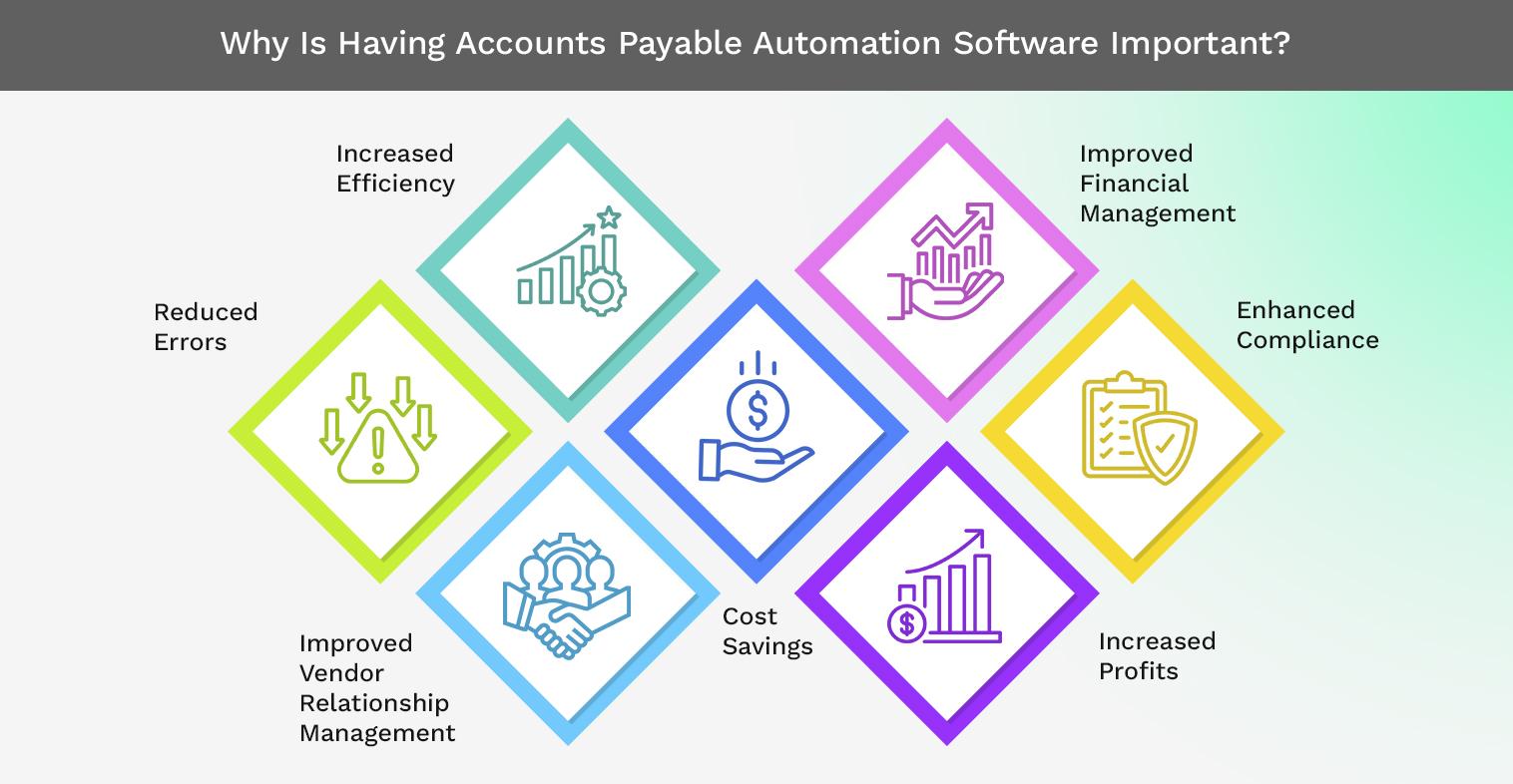

Why Is Having Accounts Payable Automation Software Important?

Having accounts payable automation software is important because it streamlines the payment process, reducing manual errors and saving time for businesses. This software helps ensure that invoices are processed quickly and accurately, improving cash flow management and strengthening supplier relationships.

Automating accounts payable also provides better visibility into financial data, making it easier to track expenses and manage budgets. With fewer manual tasks, employees can focus on more strategic activities, leading to increased productivity and efficiency within the company.

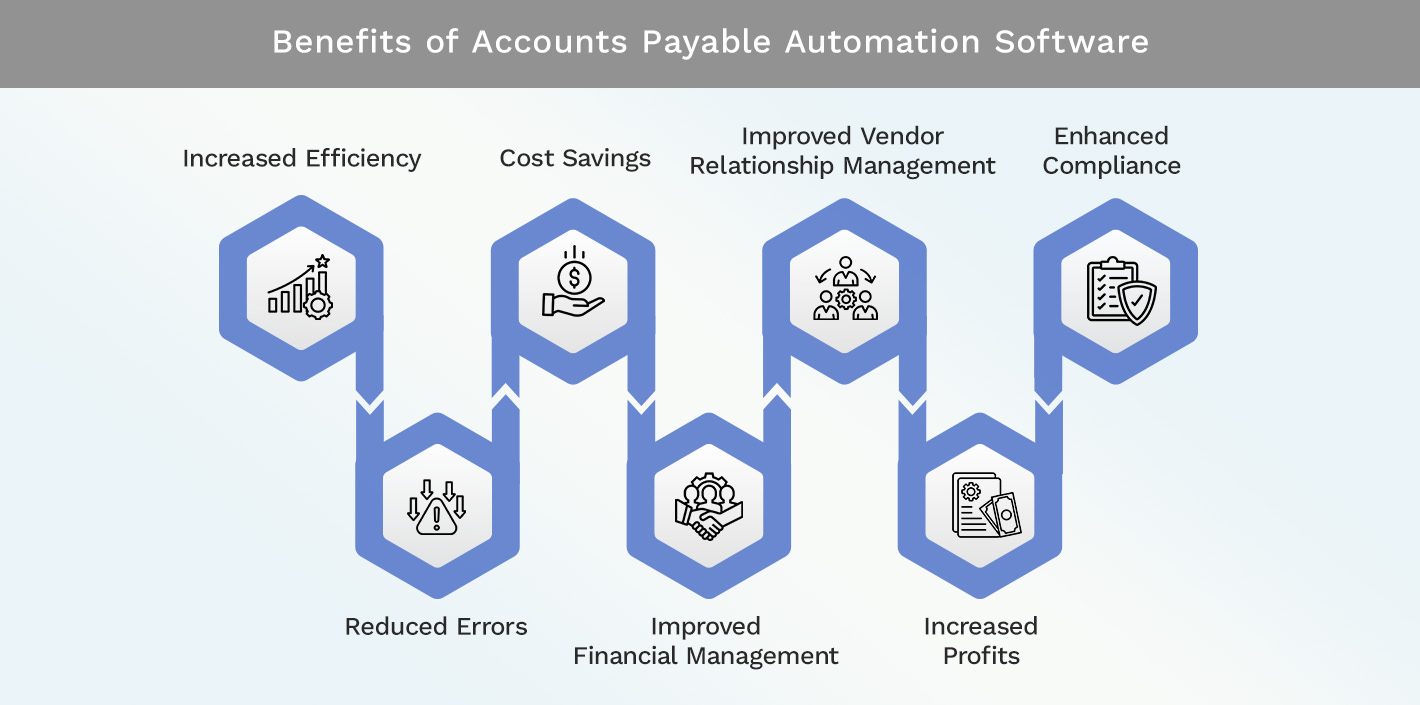

Benefits of Accounts Payable Automation Software

These tools have many advantages. They can improve your money management and help everything run smoother. Here are the most important benefits.

Increased Efficiency

Accounts payable automation makes paying bills easier. It cuts down on manual work. An example is putting in invoice numbers by hand. The software takes over, saving you lots of time and hassle.

Reduced Errors

Mistakes in entering data can cause big problems. They might make you pay the wrong amount or even pay late. This software helps by doing the work without human error. It checks everything, so the numbers are always right.

Cost Savings

This technology can save your business a lot of money. It eliminates the need for some people to do jobs that the computer can do. This means you spend less and can catch some discounts when paying early.

Improved Financial Management

With this software, you get to see your money matters much clearer. You know right away who you need to pay and when. Smart choices are easier to make, making your business boom.

Improved Vendor Relationship Management

Your vendors are important. This software helps you pay them well and on time. Good relations with them mean they might give you discounts. And you'll all talk and work better together.

Increased Profits

Getting better at paying what you owe can make you more money. You get to cut some costs and might even find places to save more. Plus, you can get discounts for being quick to pay.

Improved Compliance

Following the rules about money is key. This kind of software can help by making everything clear and right. That way, you're less likely to get in trouble.

| Benefit | Description |

| Increased Efficiency | Automates manual tasks, streamlines workflow, and saves time and effort. |

| Reduced Errors | Minimizes the risk of manual data entry errors, ensuring accuracy in invoice processing. |

| Cost Savings | Eliminates manual labor costs, reduces processing time, and eliminates late payment fees. |

| Improved Financial Management | Provides better visibility and control over cash flow, enabling informed decision-making. |

| Improved Vendor Relationship Management | Strengthens relationships with suppliers, negotiating discounts, and enhancing collaboration. |

| Increased Profits | Optimizes payment operations, takes advantage of discounts, and identifies cost-saving opportunities. |

| Improved Compliance | Automates processes, enforces approval workflows, and provides secure document storage for better compliance. |

Top 9 Accounts Payable Automation Software

1. Kohezion

Kohezion is an easy-to-use software with great features. It's perfect for handling invoices and integrates well with any business.

Top 5 Features:

- Customizable invoice templates

- Real-time data synchronization

- Multi-currency support

- Comprehensive reporting tools

- User-friendly interface

Benefits:

- Reduces manual data entry

- Improves accuracy in invoice processing

- Saves time with automation

- Improves financial reporting

- Supports global transactions

Cons:

- Limited advanced features

- Initial setup can be time-consuming

Best For: Small to medium-sized businesses looking for an easy-to-use invoicing solution.

2. Tipalti

Tipalti works in the cloud, offering total automation for accounts payable. It excels in payment processing and helps businesses comply with laws.

Top 5 Features:

- Automated payment processing

- Compliance management

- Multi-entity support

- Supplier management

- Real-time payment tracking

Benefits:

- Ensures regulatory compliance

- Reduces payment errors

- Saves time with automated workflows

- Improves supplier relationships

- Improves visibility into payment status

Cons:

- Higher costs for small businesses

- Complex setup process

Best For: Medium to large businesses needing robust compliance and payment processing.

3. Beanworks

Quadient AP by Beanworks focuses on making accounts payable easier. It's known for smoothing out invoice processing and setting up custom workflows to reduce mistakes.

Top 5 Features:

- Automated invoice capture

- Customizable approval workflows

- Real-time expense tracking

- Integration with accounting software

- Secure document storage

Benefits:

- Reduces manual data entry

- Minimizes invoice processing errors

- Saves time with automated approvals

- Improves financial control

- Improves document security

Cons:

- Limited features for complex needs

- Can be costly for small businesses

Best For: Businesses seeking to streamline invoice processing and approvals.

4. Stampli

Stampli uses AI to manage accounts payable. It simplifies invoicing and approvals, eliminating the need for paper and increasing productivity.

Top 5 Features:

- AI-powered invoice processing

- Collaboration tools

- Real-time data synchronization

- Seamless ERP integration

- Customizable workflows

Benefits:

- Reduces invoice processing time

- Improves collaboration on invoices

- Minimizes manual data entry

- Improves approval efficiency

- Increases productivity

Cons:

- Can be expensive for smaller businesses

- Requires some training to use it effectively

Best For: Companies looking to leverage AI for efficient accounts payable management.

5. Bill

Bill works online, automating everything from capturing invoices to checking payments. It's great for businesses that want to be more efficient and accurate.

Top 5 Features:

- Automated invoice capture

- Payment processing

- Approval workflows

- Integration with major accounting systems

- Expense tracking

Benefits:

- Saves time with automation

- Reduces payment errors

- Improves financial accuracy

- Improves approval process efficiency

- Provides better expense management

Cons:

- Higher cost for smaller businesses

- Limited customization options

Best For: Businesses seeking a comprehensive online accounts payable solution.

6. AvidXchange

AvidXchange is a powerful automation tool. It easily integrates with your current ERP system and makes handling payments smoother and cheaper.

Top 5 Features:

- Invoice automation

- Payment processing

- ERP integration

- Approval workflows

- Supplier management

Benefits:

- Reduces invoice processing time

- Saves on payment processing costs

- Improves financial control

- Improves supplier relationships

- Increases efficiency with ERP integration

Cons:

- Complex initial setup

- Higher costs for small businesses

Best For: Medium to large businesses with existing ERP systems.

7. MineralTree

MineralTree handles everything from capturing invoices to sending payments. It's smart in guiding payments and keeps things secure, making it a top choice.

Top 5 Features:

- Invoice capture

- Payment processing

- Fraud detection

- Integration with accounting systems

- Approval workflows

Benefits:

- Improves payment security

- Reduces manual data entry

- Saves time with automated processes

- Improves financial visibility

- Minimizes payment errors

Cons:

- Higher cost for smaller businesses

- Limited customization options

Best For: Businesses needing secure and efficient accounts payable automation.

8. Airbase

Airbase helps with spending and accounts payable. It's simple to use and automates approvals, helping you better control your budget.

Top 5 Features:

- Spend management

- Invoice processing

- Approval workflows

- Real-time expense tracking

- Integration with accounting software

Benefits:

- Improves budget control

- Saves time with automation

- Reduces manual errors

- Improves financial visibility

- Simplifies expense tracking

Cons:

- Higher cost for smaller businesses

- Learning curve for new users

Best For: Companies looking to manage both spend and accounts payable efficiently.

9. Centime

Centime blends accounts payable automation with a handy vendor portal. It uses smart tools for analysis and tracking payments, making it a great all-around choice.

Top 5 Features:

- Vendor portal

- Invoice automation

- Payment processing

- Financial analytics

- Approval workflows

Benefits:

- Improves supplier relationships

- Improves financial insights

- Saves time with automation

- Reduces payment errors

- Streamlines approval process

Cons:

- Higher cost for smaller businesses

- Limited customization options

Best For: Businesses seeking a comprehensive accounts payable solution with vendor management features.

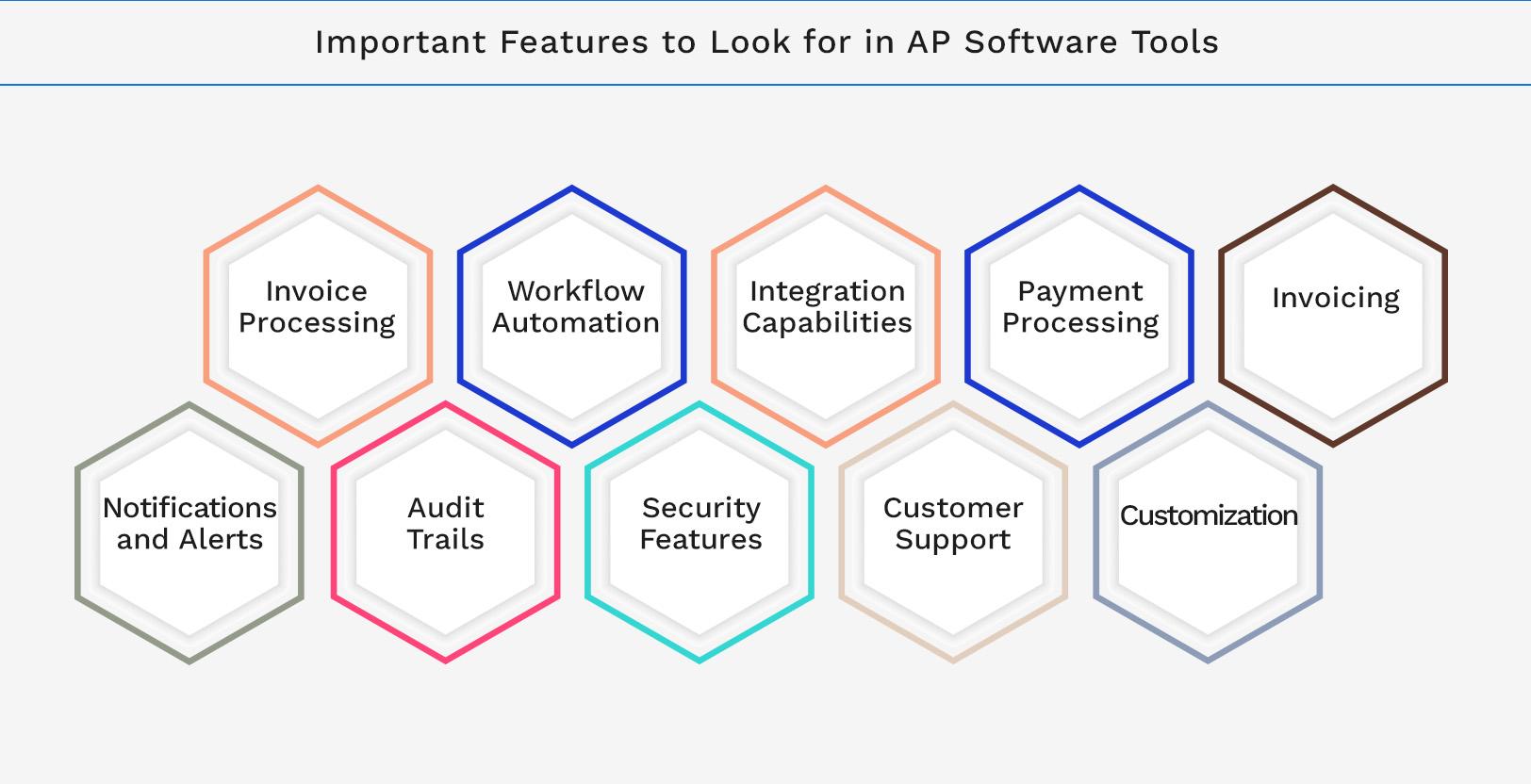

Important Features to Look for in AP Software Tools

When you pick accounts payable software for your company, certain features can increase your efficiency. It's key to look for tools that make your financial processes smoother. These are the features you should focus on:

Invoice Processing

The software should efficiently manage invoices. It should extract data automatically, match invoices, and follow approval workflows. This reduces errors and makes invoice management easier.

Workflow Automation

Automation cuts down on manual work and speeds up approvals. Choose software with flexible workflows and reminders to ensure invoices are approved and paid on time.

Integration Capabilities

Software that integrates well with your other systems is a must. It should work smoothly with your accounting or ERP systems, creating a united, precise financial setup.

Payment Processing

Look for software that simplifies paying suppliers. It should handle a variety of payment methods and produce payment reports. Options like ACH, virtual cards, and check printing are important.

Invoicing

Comprehensive invoicing features streamline bill management. Opt for software with easy-to-use invoice templates, automatic generation, and tracking. This maintains clear payment records.

Notifications and Alerts

Real-time alerts keep you updated on critical tasks. Find software with customizable notifications. This ensures you stay on top of upcoming payments or approvals.

Audit Trails

Keeping your accounts transparent and secure is crucial. Choose software with strong audit trail functions. It should track all actions within the system, ensuring accountability.

Security Features

Your financial data's safety should be a top priority. Pick software with robust security features like encryption, access controls, and backups. This protects your data from threats.

Customer Support

Good support is essential for handling any issues with the software. Choose software with responsive customer support via phone, email, or live chat. This eases potential software problems.

Customization

Being able to customize is great for tailoring the software to your needs. Look for software that lets you adjust the interface, create reports, and manage user roles. It should fit your unique needs.

Automate Your Accounts Payable Software with Kohezion

Kohezion is a leading solution for accounts payable automation. It helps businesses streamline their financial workflows. Kohezion can automate your accounts payable process, making your work more efficient.

Kohezion is designed to meet business needs for processing invoices and managing workflows. It also offers advanced integration for seamless payment processing. Let's look at what makes Kohezion perfect for automating accounts payable.

"Kohezion revolutionized our accounts payable department. The automation features have significantly reduced manual errors and accelerated our payment processing speed. The integration capabilities allow seamless data transfer between systems, making our workflows more efficient."

Using Kohezion helps businesses automate and streamline their accounts payable system. This saves time and money, improves accuracy, and results in faster payments. It also improves financial management and vendor collaboration, which can increase profits.

Conclusion

Accounts payable automation software is key to improving finance in companies. The right software can increase efficiency, lower mistakes, and save money.

This article highlighted how such software helps manage money better and keep vendors close. Using this type of software helps businesses reduce errors, ditch paper problems, and pay vendors on time.

If you're considering getting one in 2024, there are many great options, like Kohezion.

When picking software, consider what you need, such as handling invoices, automating work, and keeping things secure. Choosing the best fit for your business means you'll enjoy all the perks of automated accounts payable.

For more information about Kohezion, contact us today.

Start building with a free account

Frequently Asked Questions

Accounts payable automation software typically integrates with existing ERP systems through APIs, allowing seamless data exchange between the systems. This integration ensures that data such as invoices, payments, and vendor information are automatically synchronized, reducing the need for manual data entry. It also helps maintain consistency and accuracy across all financial records, improving financial management.

Accounts payable automation software employs different security measures to protect sensitive financial data. These measures include data encryption in transit and at rest, multi-factor authentication, and role-based access control to ensure that only authorized users can access certain information. Regular security audits and compliance with industry standards like GDPR and SOC 2 help ensure that the software remains secure against potential threats.

Accounts payable automation software supports multi-currency transactions by automatically converting currencies based on current exchange rates. This feature ensures businesses can process invoices and payments in different currencies without manual calculations. It also provides comprehensive reporting and analytics to track and manage currency fluctuations, helping businesses make informed financial decisions.

One common misconception is that accounts payable automation software only benefits large companies. In reality, businesses of all sizes can benefit from the software's efficiency and accuracy improvements. Another misconception is that implementing the software is overly complex and time-consuming. Still, many solutions are designed for easy setup and user-friendly operation, making them accessible even for smaller organizations.